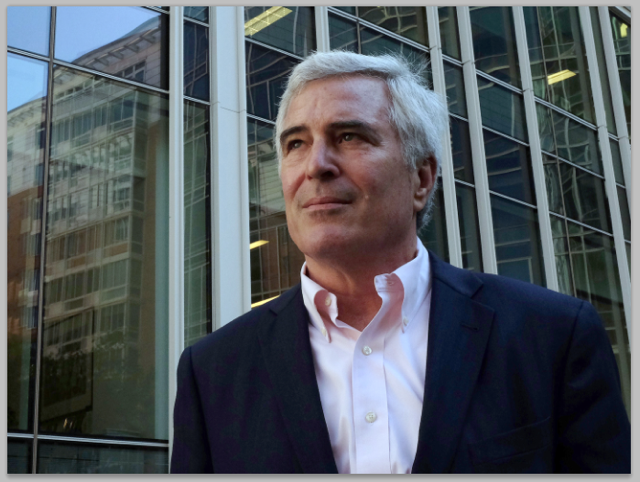

No one knows exactly what’s in Midtown Manhattan, according to Chris Leinberger, chair of the George Washington University Center for Real Estate and Urban Analysis (CREUA).

Like all of the neighborhoods in New York City’s five boroughs, the total real estate value, the square footage dedicated to to public and private organizations, the product mix and GDP of Midtown’s iconic stretch is a mystery. Since real estate is the largest asset of the local economy, that’s a problem for urban planners and private developers, Mr. Leinberger said.

“It may sound amazing because we are such a sophisticated country, but we don’t have one source that knows how big metropolitan New York is as far as real estate,” Mr. Leinberger said. “We don’t even know how big Midtown is. We don’t know the number of buildings, the amount of square footage or the product mix.”

To solve the mystery of Midtown, Mr. Leinberger, who is also the GW Charles Bendit Distinguished Scholar and Research Professor, will undertake the first real estate and “walkability” survey of metropolitan New York this fall. The goal is to uncover “where people want to live, work and play.”

The research project is produced in collaboration with Metro New York and the Regional Planning Association.

“The Regional Planning Association is working on a strategic plan for New York City, and they are concerned about building resiliency following Hurricane Sandy,” he said. “There is a need to know more about— not just real estate—but what jobs people have and what industries are growing so that we can start to project the economic impact on real estate values, tax revenues and GDP.”

Midtown Manhattan is home to some of New York City's most famous landmarks including the Empire State Building. Reports differ on it's size, but Midtown is said to stretch from 59th Street as far south as 14th Street.

Mr. Leinberger and CREUA have developed research reports on 11 metropolitan areas to date including Atlanta, Washington, D.C., Boston and Detroit. The research shows that “walkable urban places,” such as Washington, D.C.—which has urbanized the suburbs of Maryland and Virginia and redeveloped its center city—are the future of the real estate market, he said.

The research is born out by the price premium placed on walkable urban areas, which starts at $300 per square foot of real estate in walkable cities versus $150 per square foot in suburban areas. He said that about 80 percent of new development would be confined to 10 percent of existing developed land.

“The research demonstrates what kind of real estate should be developed, and it will define where office space will go, where housing and retail will be sold and what will be transformed from drivable suburban areas to walkable urban areas,” Mr. Leinberger said.

“We know there is a pent up demand for walkable urbanism—just look out at all of the cranes on the horizon.”

The possibility of changing the face of metro New York poses unique opportunities and challenges, he added. Unlike the metro D.C. area which has relatively few local governments and only two states and the District of Columbia, metro New York includes parts of four states—New York, New Jersey, Connecticut and Pennsylvania—and more than 400 local jurisdictions.

Of those areas, 40 percent of the population lives in New York and 90 percent of walkable urbanism is on Manhattan Island. Metro New York also has fewer urbanized suburbs such as downtown Princeton.

“Getting infrastructure right will start with transportation, and the demand is really being driven by Millenials,” Mr. Leinberger said. “For 100 years, vehicle miles traveled were in lock step with the GDP, but then in 2001 Millenials started driving less and changed all that—sprawl is over.”

While Mr. Leinberger’s research will focus on economic performance and “social equity”—defined as affordable housing and access to transportation—he says that future considerations for this type of research will include environmental benefits, public health and the relationship between crime and walkable urbanism.

“This country has been developing land at a pace that the world has never seen before, and that is now reversing. The vast majority of development is going inward to redeveloping undervalued and abandoned areas,” Mr. Leinberger said.

“The capitalized value of all private real estate and development companies is two times the the combined value of all publicly traded stocks. As the largest asset class, we need a national understanding of real estate just as we have a national understanding of publicly traded companies.”