By Tatyana Hopkins

Charlinda Sims, M.Accy. ’15, made the final payment last July on her $80,000 student loan balance after just four years of payments, and she credits a personal finance course she took as a graduate student at the George Washington University as getting her “really fired up” about paying off the loans as soon as possible.

The course, “Personal Finance and Accounting,” will be available to undergraduate students for the first time in the spring 2019 semester.

“Seeing the cold, hard numbers made it a no-brainer to pay my loans off sooner than later,” Ms. Sims said. “I had to figure out how to increase my income and at the same time reduce my expenses.”

After establishing an emergency fund of three to six months’ living expenses, Ms. Sims tackled her debt using the avalanche method, which eliminates debts with the highest interest rates first regardless of balance to help save money on interest. An amortization chart kept her on track.

To maximize her $50,000 salary and pay her debt faster, Ms. Sims reduced her expenses primarily by moving back in with her parents and finding cheaper alternatives to the things she enjoyed such as replacing expensive shopping trips with thrifting. She also found ways to increase her income by preparing taxes during tax season, driving for Lyft and selling old clothes and shoes.

Although her salary nearly doubled over the years, Ms. Sims maintained her low-expense living and put any extra money she made toward her debt.

Ms. Sims admits that a big factor in paying her loans off quickly was reduced living costs, but said consistency was also key. She said others could find practical ways to reduce their expenses, and to help she began an Instagram page to share her repayment story.

“Everyone should focus on what’s right for them and go at their own pace,” Ms. Sims said.

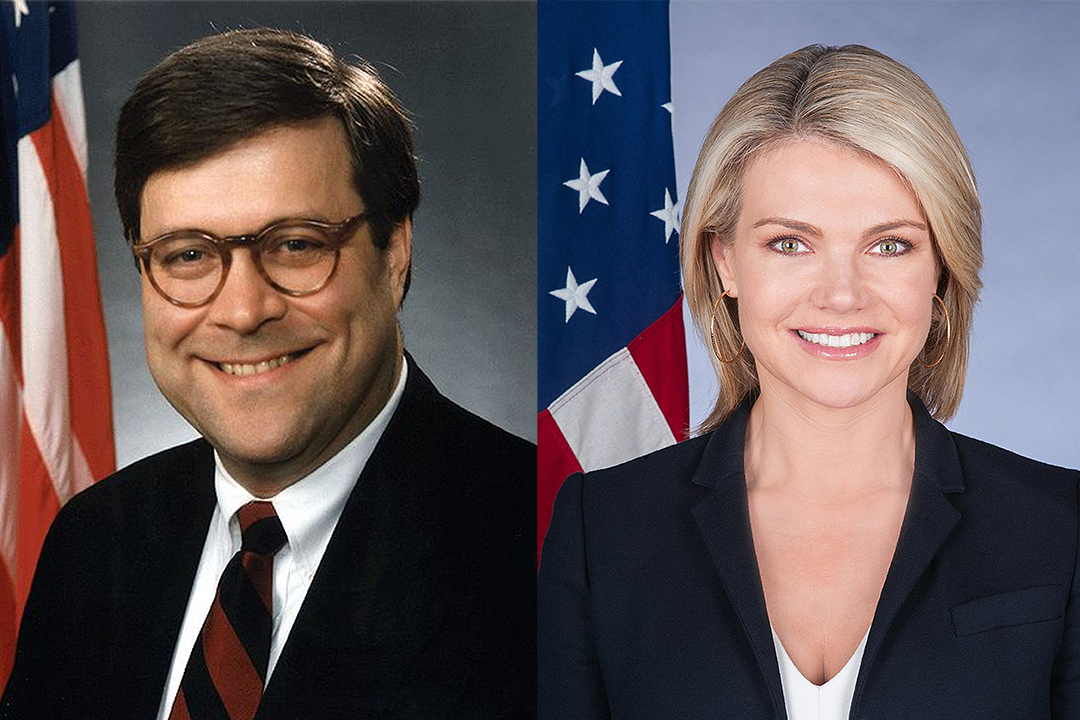

Taught by GW School of Business professor Annamaria Lusardi, the Denit Trust Endowed Chair of Economics and Accountancy, the objective of the personal finance course is to provide the knowledge necessary to evaluate the wide range of financial decisions individuals make throughout their lifetime. It covers topics such as saving, investing, consumer borrowing, personal taxes and financial planning.

“To understand how to pay off your student loans, you have to make some calculations,” she said. “We teach students how to make those calculations and everyone can do them, even those who are not good at math.”

[video:https://vimeo.com/176667708 width:560 height:315 align:center lightbox_title:Annamaria Lusardi]

She said the course helps students develop economic and financial literacy by providing practical applications for various complex financial decisions such as calculating the monetary value of additional education or relocating for a job, evaluating business projects, making and valuing investments and planning for their financial futures.

Over the past 15 years, Dr. Lusardi has been a pioneer in research and the development of financial literacy as a field of study. She said she hopes GW will be a leader in educating students about personal finance.

She founded and is the academic director of the GW Global Financial Literacy Excellence Center (GFLEC). She developed the personal finance course for GW as well for other institutions to adopt and teach.

“There are courses on corporate finance, which basically teaches [professionals] how to manage money for a firm,” she said. “If we think firms have to allocate money rationally, why not individuals?”

She said her research indicates that in general the level of financial literacy across the nation is “incredibly low,” but disproportionately so among young people, women, older people, minorities and those with low educational attainment.

“Ignorance is not bliss,” Dr. Lusardi said. “Ignorance has consequences and big costs.”

She said low financial literacy makes people more vulnerable to financial fragility, and with young people at the helm of the nation’s collective $1.5 trillion student loan debt, it is important that they be equipped to make sound financial decisions in today’s complex economic environment.

“People think personal finance is about saving more or borrowing less—no—that’s not the objective,” Dr. Lusardi said. “Personal finance is about achieving your dreams.”